Like consumers unsure what tariffs will mean for prices on store shelves, the leaders of some of Georgia’s largest companies are also having a hard time predicting how they will perform this year because of the uncertainty.

Atlanta-based Delta Air Lines, children’s apparel retailer Carter’s, shipping giant UPS and Rubbermaid maker Newell Brands have each backpedaled on previous forecasts or told investors they are refraining from giving guidance on their expectations for this year.

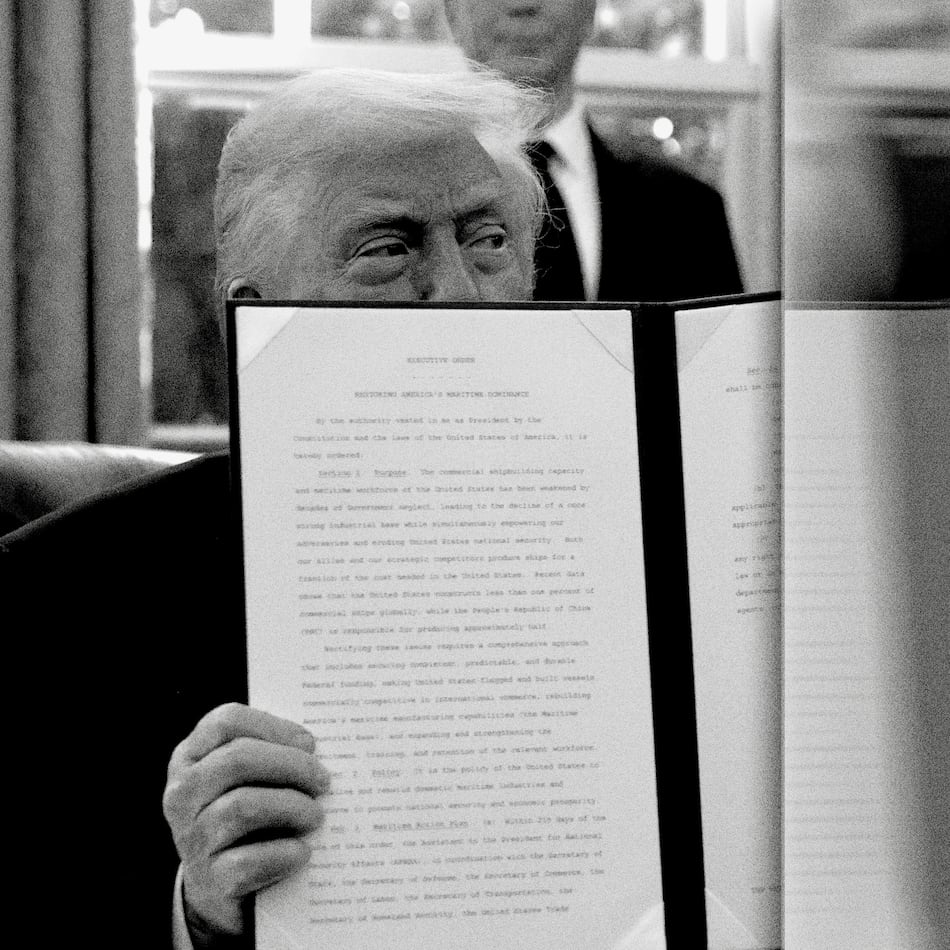

President Donald Trump’s trade war has caused consumer confidence to fall. Business sentiment has also suffered with executives unsure what lies ahead.

Amid the uncertainty, companies and investors are watching for every sign of where the economy is headed. The U.S. economy contracted by 0.3% on an annualized basis in the first quarter as businesses rushed to import goods ahead of Trump’s tariffs and consumer spending softened.

The federal jobs report Friday said U.S. companies added 177,000 jobs in April, down slightly from a revised 185,000 in March. But economists had expected worse, forecasting that only 135,000 jobs would be added in April. The latest figures kept the unemployment rate at 4.2%.

Sandy Springs-based UPS would not confirm its prior annual financial projections “given the current macroeconomic uncertainty” facing its customers.

Credit: TNS

Credit: TNS

“The world hasn’t been faced with such enormous potential impacts to trade in more than 100 years, so the only thing we’re certain of, is we don’t know which, if any, of our scenarios will play out,” CEO Carol Tomé told investors April 29. Still, she said the company is well-positioned to “manage through” the situation.

UPS serves consumers and also businesses small and large, making the company a bellwether of the global economy and giving it unique insights into economic sentiment.

Tomé said that in February and March, “uncertainties surrounding global trade policies and other matters led to a drop in consumer confidence and muted demand” from some businesses.

“In the U.S., we’ve talked with our top 100 customers to understand how their business is being impacted, both directly and indirectly by changes in trade policy,” Tomé said. Those customers are exploring how to address the tariffs, from absorbing the cost to increasing retail prices to asking suppliers to help defray the expense, she said. “At this point, it remains an open question as to what path they will choose and what the potential impact could be on consumer demand and our business.”

Globally, the vast majority of UPS customers that are shipping small packages said they plan to maintain their business models. But some companies are considering making shifts in trade or shifting from air freight to ocean freight, or even exiting a business, Tomé said.

Many of the small and medium-sized businesses that are UPS customers “are 100% single-sourced from China, and this is causing so much uncertainty in the marketplace” because of the latest 145% tariff on most China goods taking effect Friday, she said. That new tariff comes with the end of a duty-free exemption for small packages from China worth less than $800, which could make purchases from e-commerce giants such as Shein and Temu much more expensive.

When it comes to the outlook for the future, “given the uncertainty in the market, there is a wide range of possible outcomes,” Tomé said.

An Atlanta Journal-Constitution poll released this week showed souring consumer sentiment. As Trump took office in January, 56% of Georgia voters expected the U.S. economy to improve in his first year in office. Now, that figure sits at just 43%, the AJC poll showed.

Nearly 60% of survey respondents said they are cutting back on purchases, as they wait to see how Trump’s trade negotiations play out.

Carter’s joined the list of companies that declined to give a financial outlook for this year because of uncertainty from tariffs and other economic concerns.

The company, known for its Carter’s stores and clothing, OshKosh B‘Gosh denim and Skip Hop accessories and toys, has a new CEO, Douglas Palladini, who plans to work to overcome past challenges and improve profitability.

But tariffs add another thick layer of uncertainty.

“Given the Company’s recent leadership transition and significant uncertainty surrounding proposed new tariffs and potential related impact on the business, the Company is suspending its forward guidance,” the company said in its first quarter earnings press release.

Carter’s has done an analysis of the tariffs. “But since it is hypothetical, and we’re certainly hoping that cooler heads, more rational heads, will prevail, agreements will be reached, we’re not going to quote a number today,” said Carter’s Chief Financial Officer Richard Westenberger during an earnings call in late April.

“The proposed higher tariffs would result in meaningful increases to our product costs, if not otherwise mitigated,” Westenberger said.

“While we understand the objective of expanding manufacturing activity in the United States, very little baby or children’s apparel is produced outside of Asia,” he said.

Westenberger also said he “just wanted to make the point that for a company that I think has done an excellent job diversifying its sourcing base, creating broad-based capabilities around the world, reducing our reliance on China for all the right reasons, this would be punitive to us, and it would be for, I think, everyone in the in the apparel industry.”

Sandy Springs-based Newell Brands, which sells everything from Sharpie pens and Coleman coolers to Rubbermaid containers and Graco baby strollers, adjusted its outlook for 2025 with its earnings release April 30, widening the range of operating cash flow it expects “because of higher tariff cost on inventory.” It also expects a decline in core sales this year.

Trump initially levied 20% tariffs on most Chinese goods, but increased those levies by an additional 125%.

Newell also reported that if the additional 125% China tariff remains in effect for the full year and is not mitigated, it would reduce its earnings for the year, by about 20 cents per share. Its current outlook for 2025 earnings per share is 70 to 76 cents, not including the additional 125% tariff.

Delta said in its first quarter earnings release in April that while it still expects “solid profitability,” its 2025 revenue could range somewhere between 2% growth and a 2% decline year over year.

The company is cutting flight capacity growth in the back half of the year, allowing “natural attrition” to shrink its workforce, managing maintenance costs and accelerating older aircraft retirements, Delta Chief Financial Officer Dan Janki said in a call with investors.

While the company still expects to be profitable for the year, “2025 is playing out differently than we expected at the start of the year,” Delta President Glen Hauenstein acknowledged in an earnings release.

The airline was originally expecting 10% growth in corporate customers this year, but that has flattened, Delta CEO Ed Bastian told the AJC.

— Staff writer Emma Hurt contributed to this article.

About the Author

Keep Reading

The Latest

Featured